19 1099MISC Software Starting at $39 for unlimited W2 1099 Filing Buy Now and Receive Instantly Saves users time and money by printing 1099MISC forms copy B (For Recipient) and Copy C (For Payer) on regular white paper This eliminates the need to buy blank 1099Must I include Copy B of 1099R form with my return?Download the readycreated record to your device or print it as a hard copy Quickly generate a 1099 B 19 without needing to involve specialists There are already more than 3 million customers taking advantage of our rich library of legal documents Join us today and get access to the top catalogue of web templates Give it a try yourself!

Printable 1099 Forms Copy B Fill Online Printable Fillable Blank Pdffiller

1099 copy b 2019

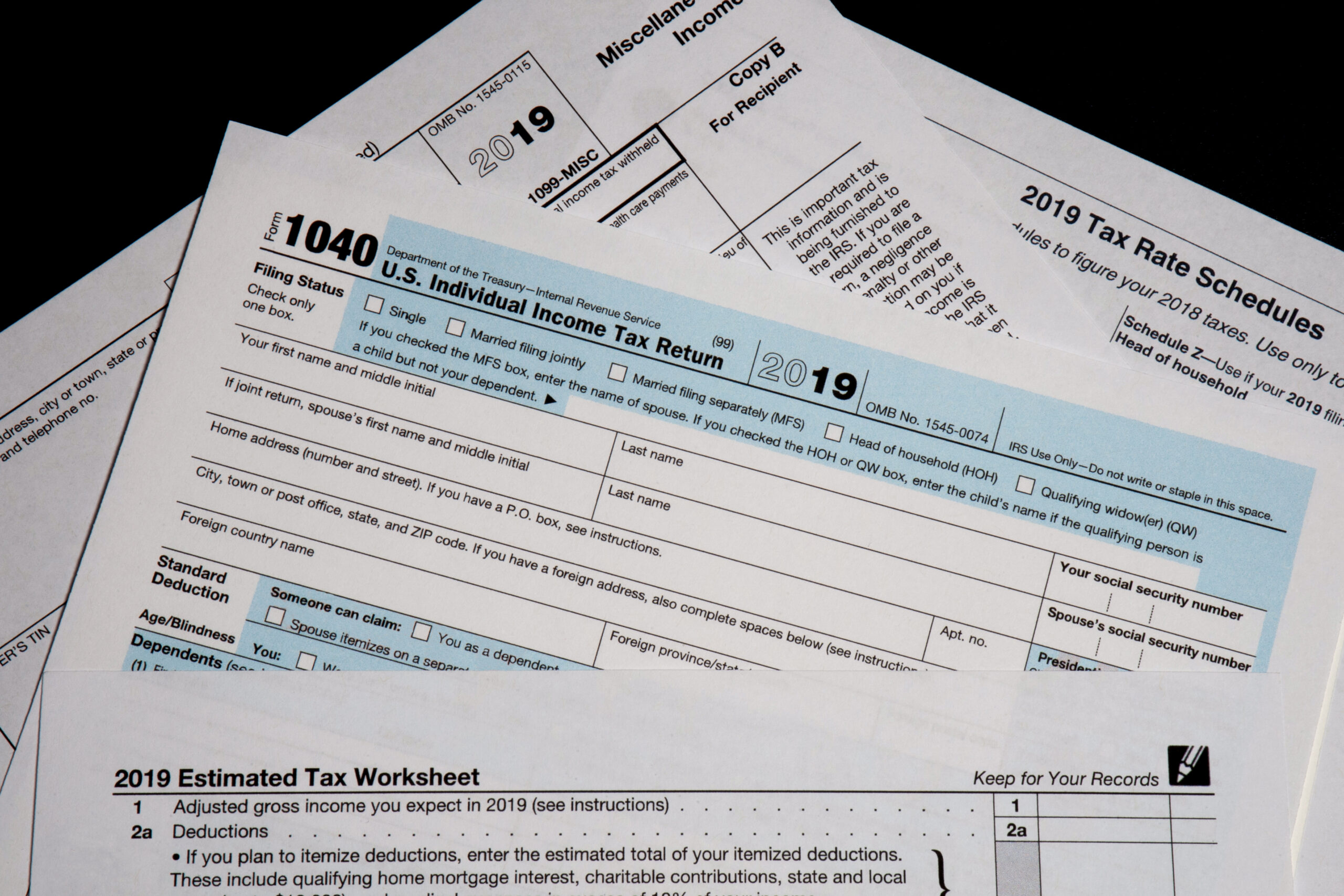

1099 copy b 2019- When the customer clicks the 1099 Wizard, they will be routed to go to 1099 EFile Service No, this is not correct I just tried it in QuickBooks desktop 17, 18, and 19 and this is not the case The 1099 wizard is local I have created many 1099's using QuickBooks and have never seen the screenshots in your postTax Year 19 State of Connecticut Department of Revenue Services IP 19(12) Failure to file the state copy of federal Form 1099K with (Field Position 6 of the Payee B record) Forms 1099 and W2G omitted from the original file must not be coded as corrections Submit these returns

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

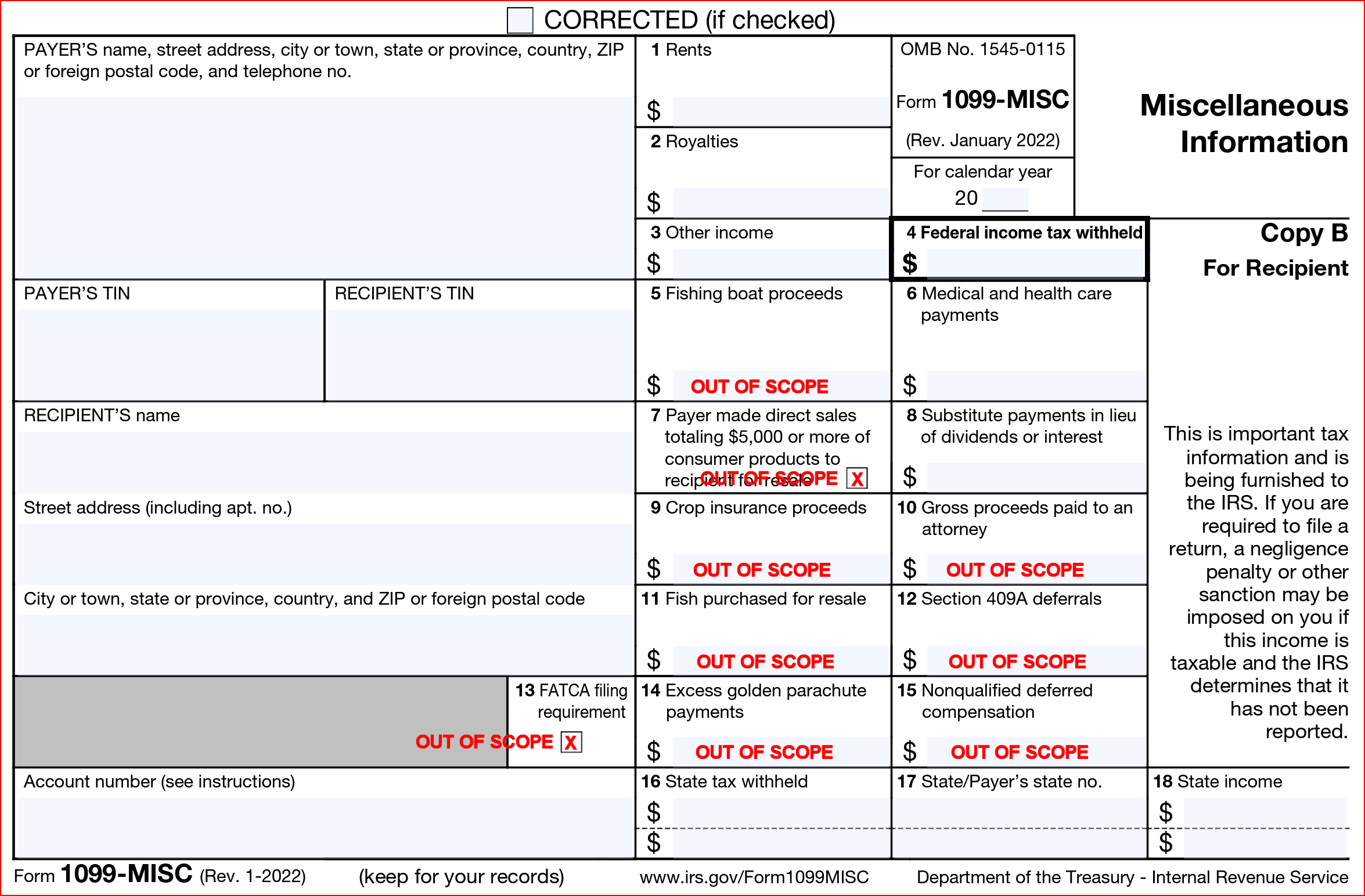

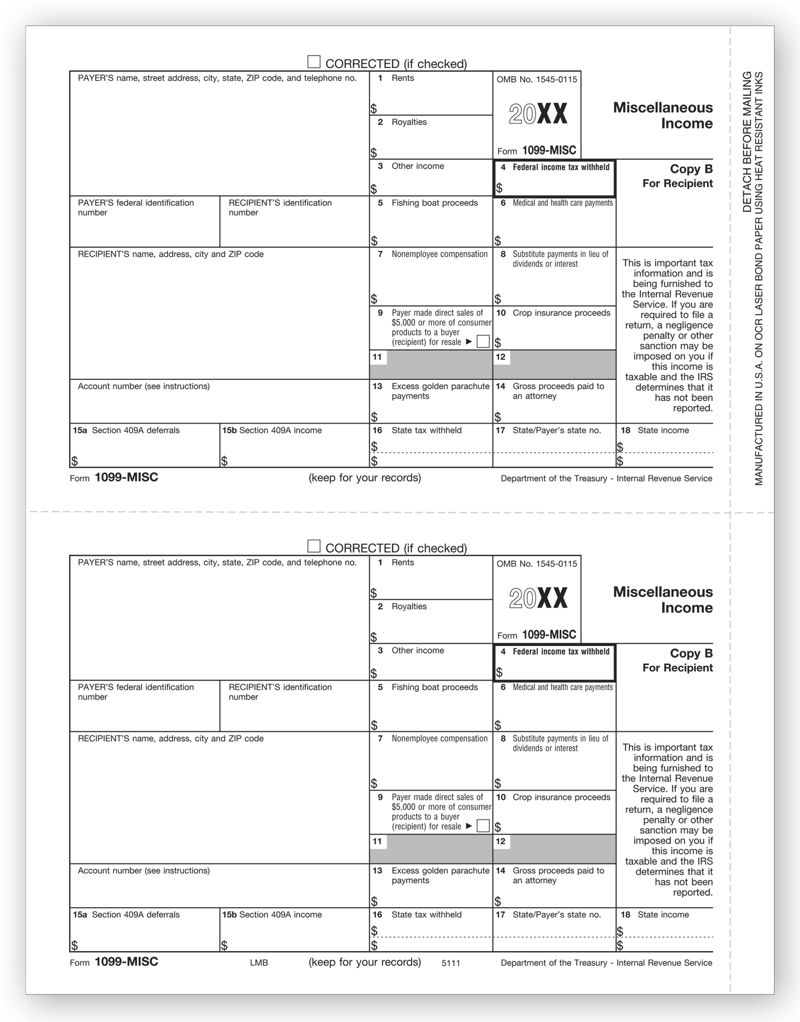

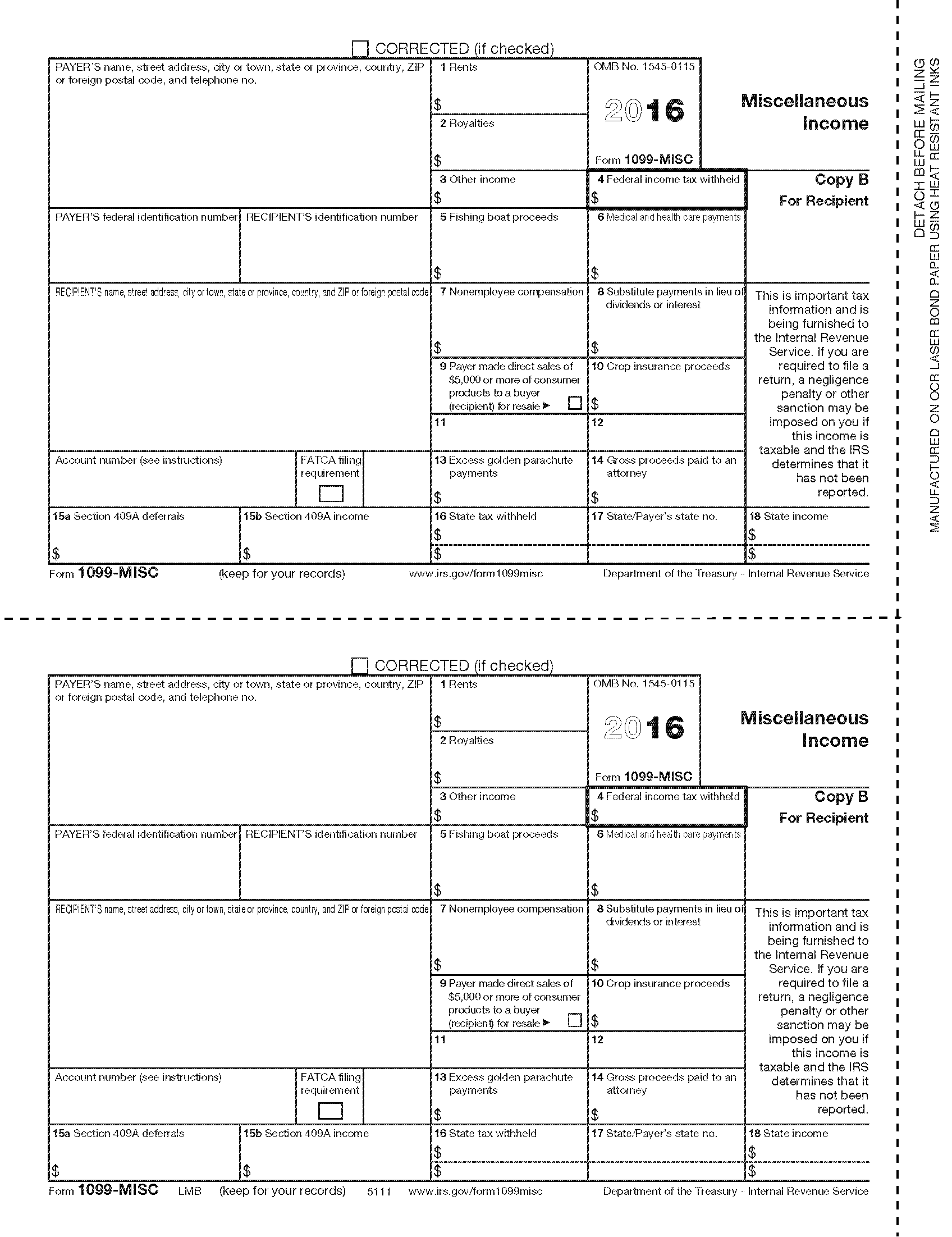

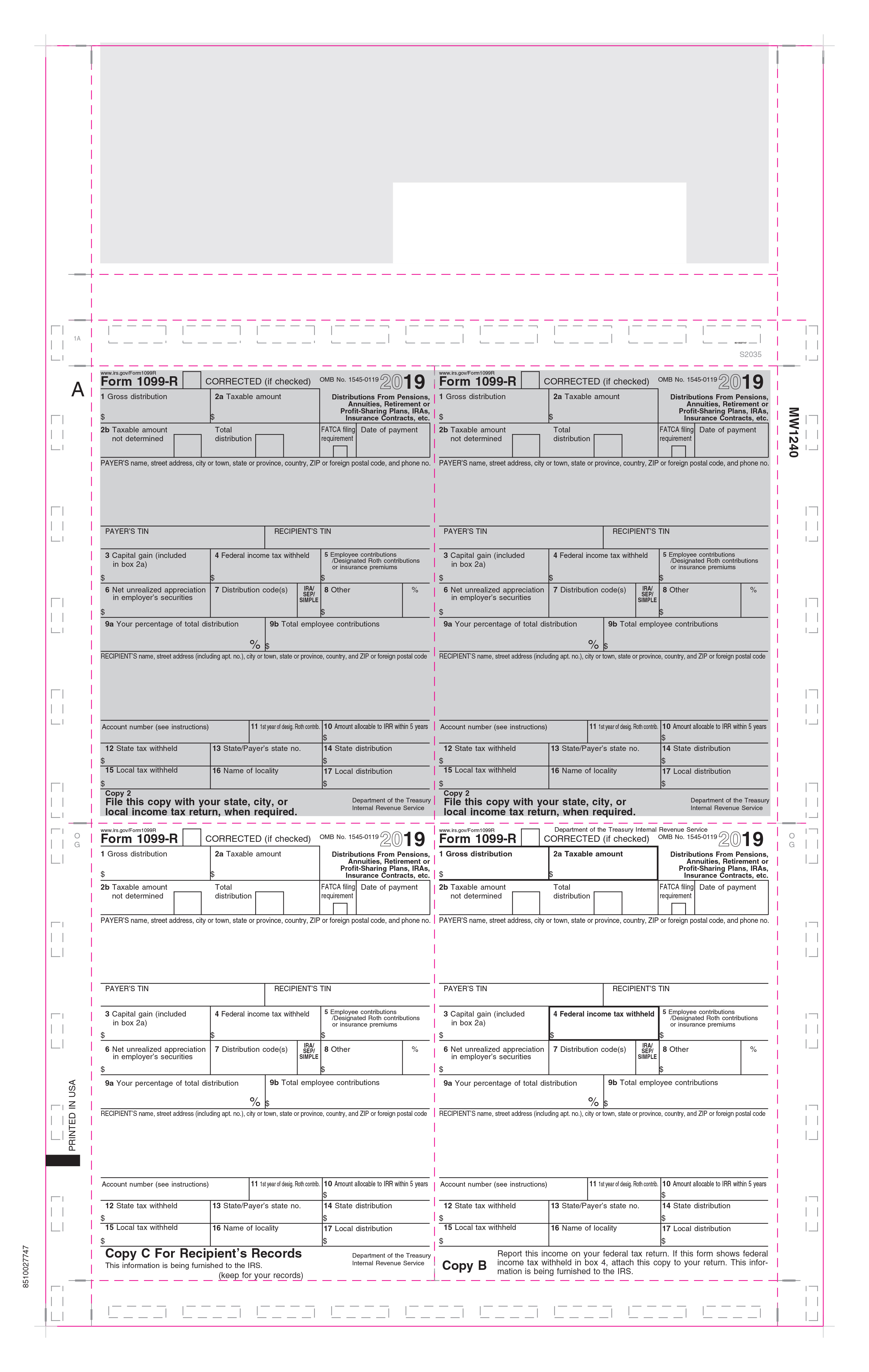

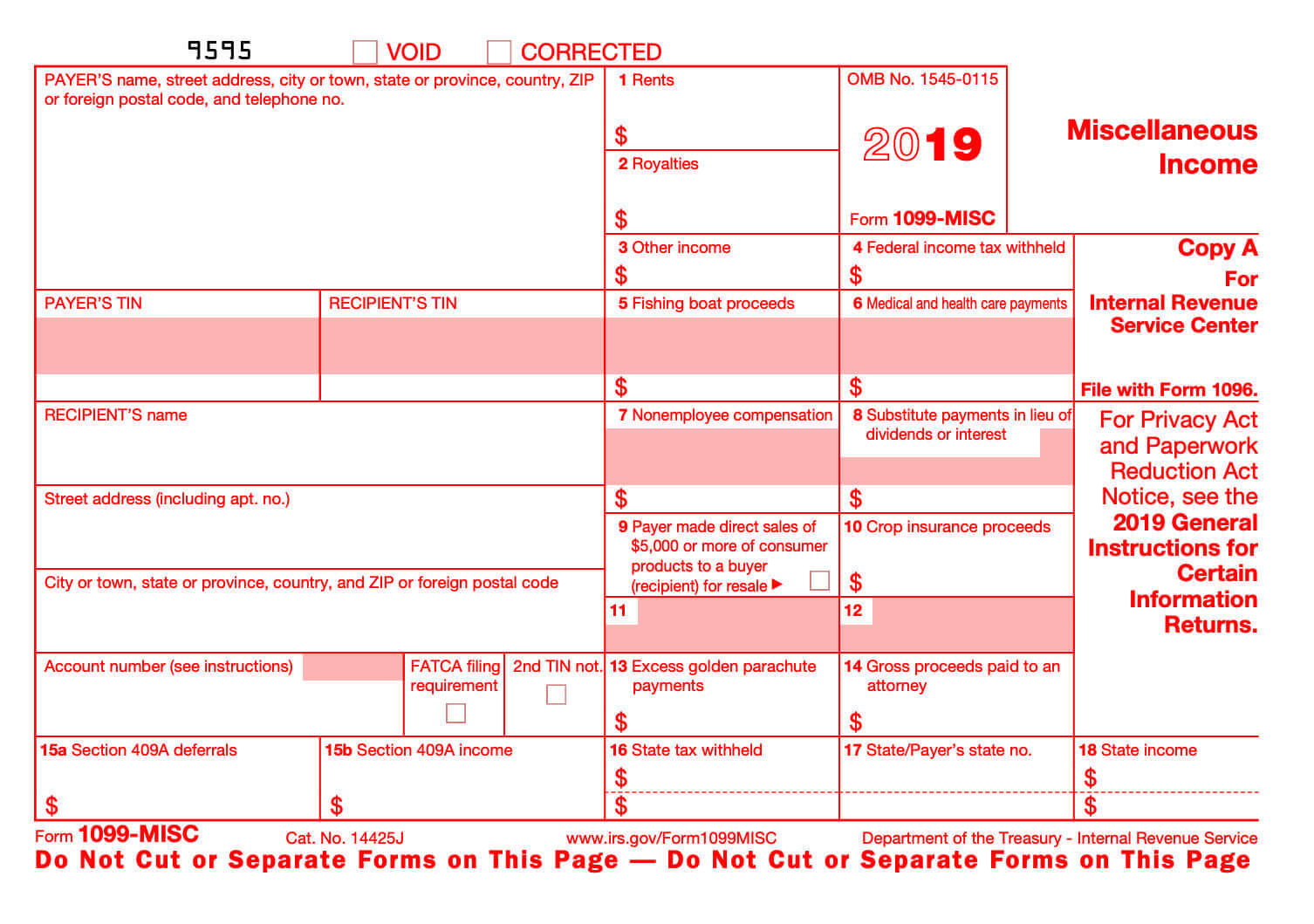

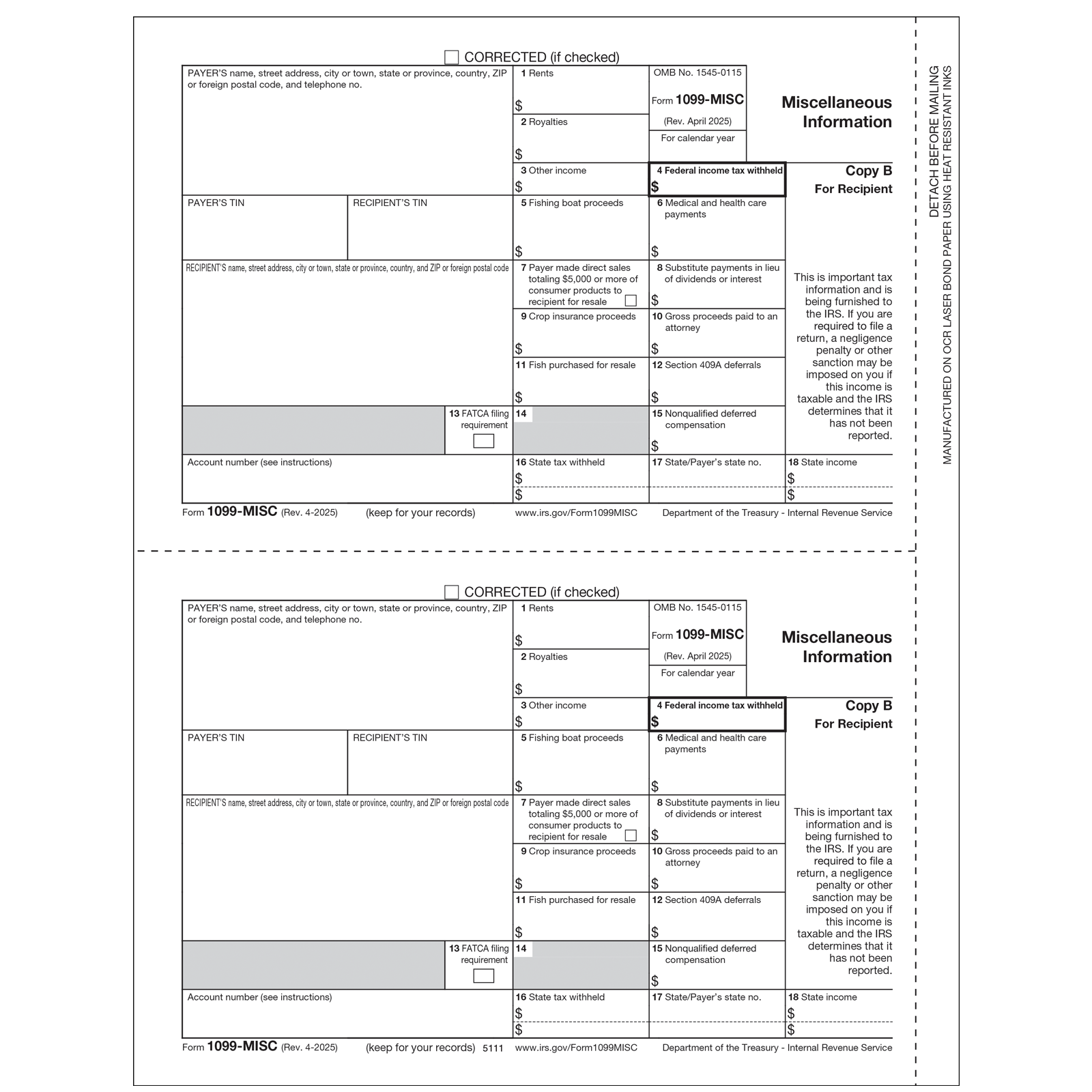

Form 1099MISC 19 Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue ServiceNote 1099 Copy B forms using the Pressure Seal filing method will print one form per sheet For 19 and earlier, Accounting CS supports the printing of only 1099MISC forms with Box 7 for nonemployee compensation type employees For and later, Accounting CS supports the printing of only Form 1099NEC for nonemployee compensation1099MISC 21 Miscellaneous Information Copy B For Recipient Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it

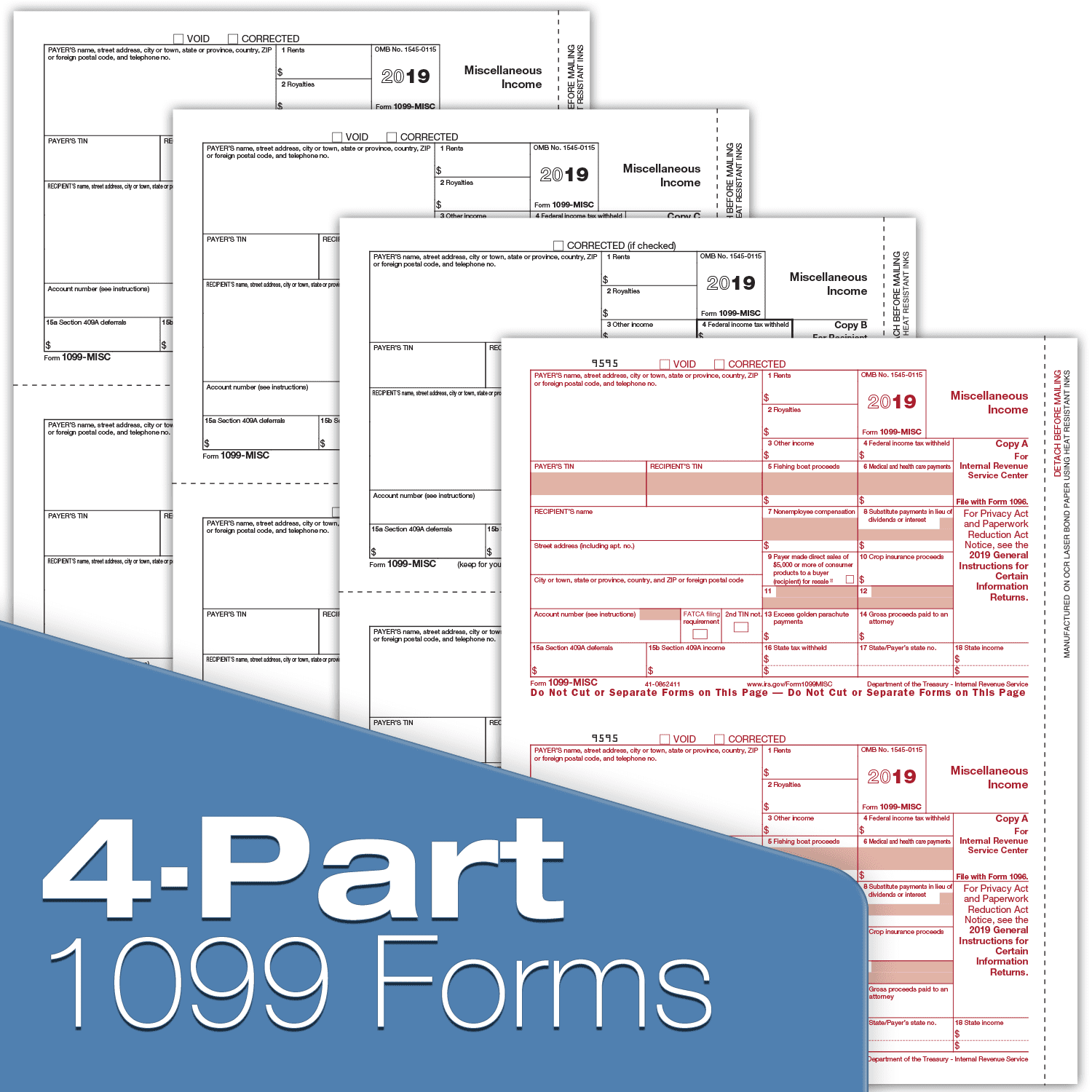

Know the Different Copies of a 1099 Form For many employers, all five copies of the 1099 form are essential Copy A—Goes to the IRS Copy 1—Goes to the state tax agency Copy 2—Goes to the recipient Copy B—Goes to the recipient Copy C—Stays with employer for record keeping W2 1099 Forms Filer PricingClick above to purchase and instantly receive your fullycustomizable preformatted 1096 and 1099MISC print template Note Actual 1099MISC forms are not included and may be ordered at no charge from the IRS Employer Returns website here Cost is $375 for the template for your personal or business use Download link will appear after checkoutPrintable 1099 form 19 are widely available All 1099 forms are available on the IRS website, and they can be printed out from home This is true for both 19 and 18 1099s, even years laterHowever, it is important to remember that each 1099 filing needs several copies of the form, and not all of them can be printed from home on regular computer paper

Instead, you must obtain a physical Form 1099NEC, fill out Copy A, and mail it to the IRS Learn how to get physical copies of Form 1099MISC and other IRS publications for free 3 Submit copy B to the independent contractor Once your Form 1099NEC is complete, send Copy B to all of your independent contractors no later than1099 MISC form should be filled accurately so the IRS can appropriately tax contractor's income 1099 Form Independent Contractor Agreement It is required to dispatch a copy of IRS 1099 Form Independent Contractor Agreement to the respective personnel by19 Laser Tax Forms 1099MISC Income (Copy B) for 25 Recipients Park Forms 3 $1402 $ 14 02 1099 MISC Form Copy A Federal Income Laser Form Pack of 25 Tax recipients 87

Missing An Irs Form 1099 Don T Ask For It Here S Why

2

1099NEC and W2 Federal Copy A Postmarked or efiled with IRS February 28 – Paper Copy A filed with the IRS for all 1099s except MISC March 31 – Efiled copies to the IRS for all 1099s except MISC These are Federal filing deadlines1099 FILING DEADLINES January 31 – All W2 & 1099 Recipient Postmarked;SET OF 25 This is the perfect package for up to 25 vendors or suppliers This set includes 25 1099 Copy A Forms (13 sheets), 25 1099 Copy B Forms (13 sheets), 50 1099 Copy C Payer/State Forms (25 sheets), 3 1096 Summary Forms and 25 Self Seal Envelopes

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Tax Preparation Services Migration Resource Center Staten Island Ny

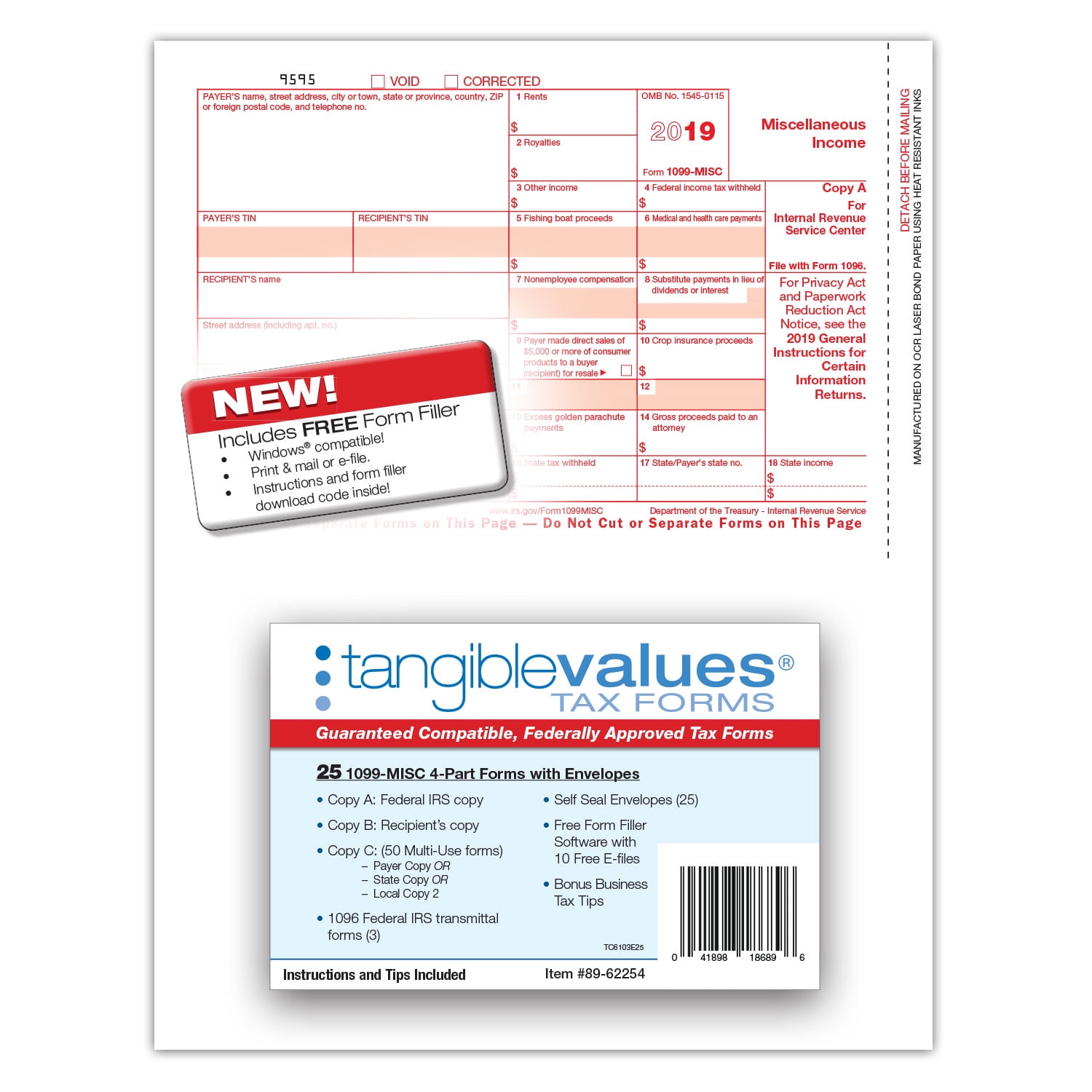

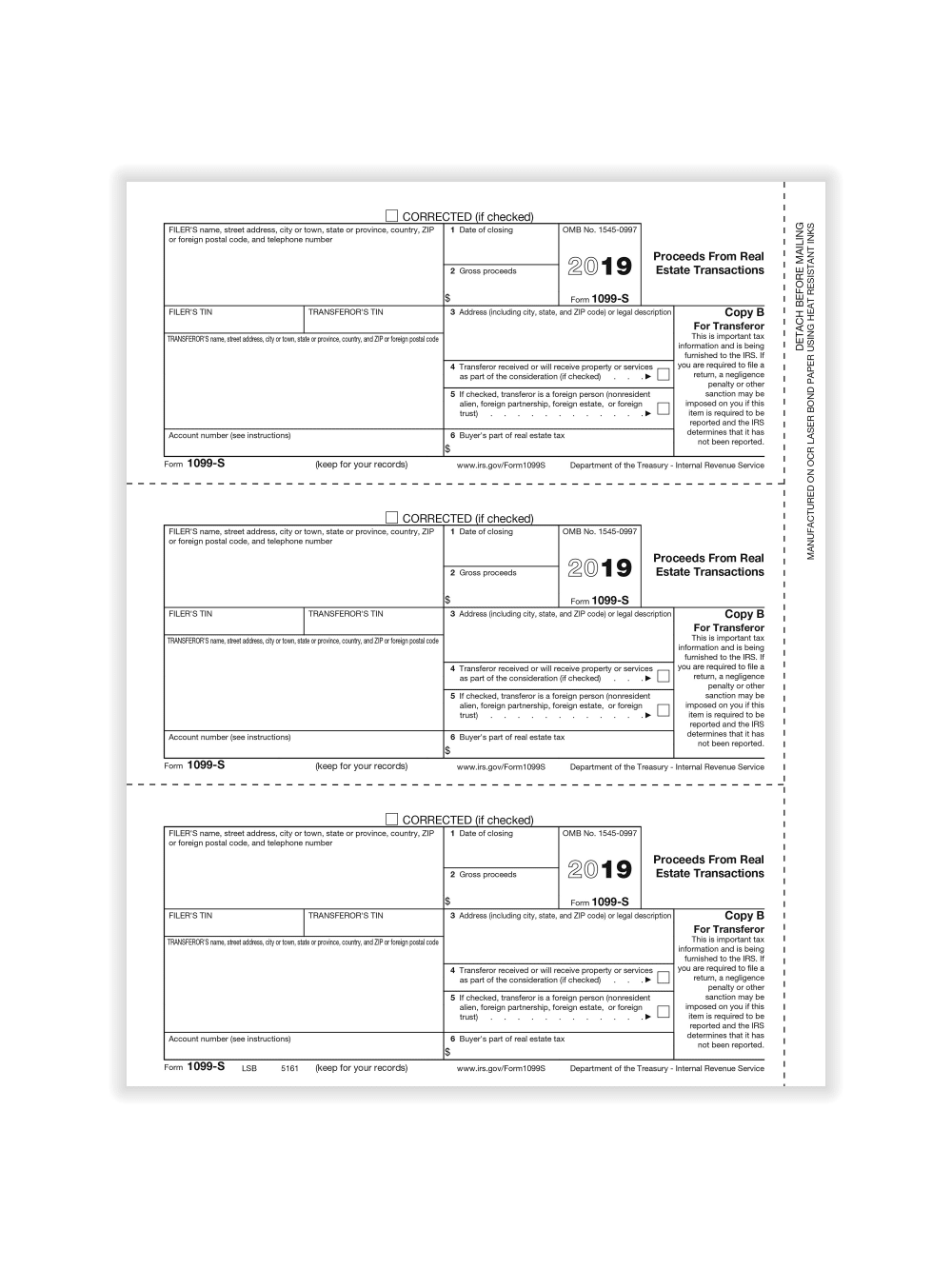

1099 Misc Copy B Additional Information ASIN B01N5TKBZ7 Customer Reviews 34 out of 5 stars 3 ratings 34 out of 5 stars Best Sellers Rank #506,3 in Office Products (See Top 100 in Office Products) #396 in Tax Forms Date First Available Feedback1099S 19 Proceeds From Real Estate Transactions Copy B For Transferor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be reported and the IRSFederal Copy A (red, scannable ink), Copy B (recipient), (2) Copy C (payer file) forms Also included are selfsealing envelopes and a bonus of three (3) 1096 summary forms With this 1099 MISC 19 kit, you can be sure you'll be in compliance with government, 4part state and IRS filing requirements

And Confidential Envelopes 2x 1096 Summary 1099 Misc Tax Forms For 19 4 Part Form Sets For 5 Vendors Filings For 5 Tax Forms Office Supplies Gulbaan Com

Tax Form 1099 Int Copy B 2 Recipient 5121 Mines Press

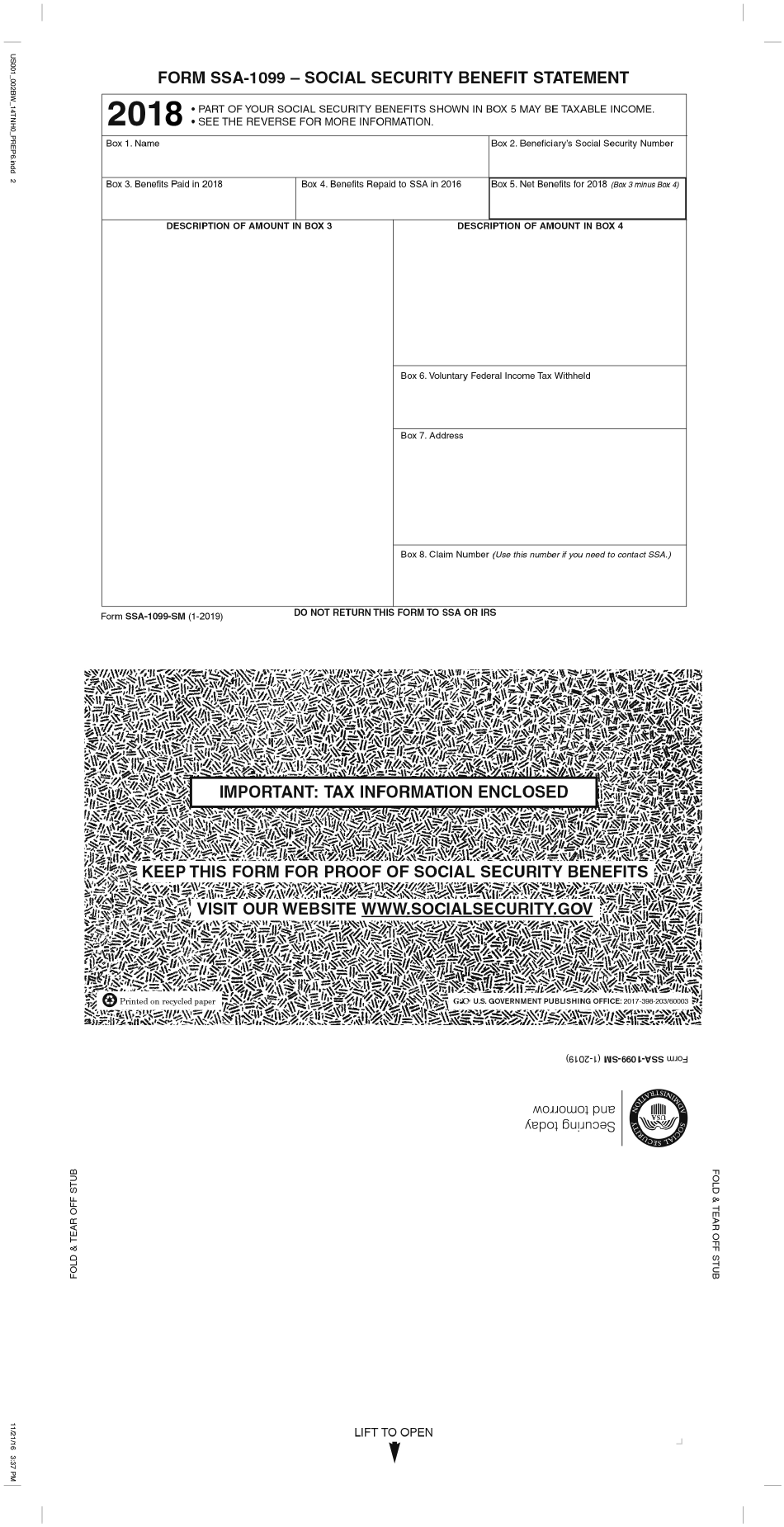

I need a copy of my 1099 for 19 and please Answered by a verified Social Security Expert We use cookies to give you the best possible experience on our website By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them Verified SSA is currently not sending paper copies through the mail of any documents so the only way to get a copy is to print it off online with option (1) below Here are the three ways that you may obtain a copy of your SSA1099 for 19 (1) You can set up a "My Social Security account" online that will allow you to print out an "official" copy of your SSA1099, as5498 SA Copy A (Year 19) 30 forms (10 Sheets) $995 Out of stock W2G (Year 19) forms (10 Sheets) $995 Out of stock Note There will be only one single shipping charge for USPS Priority Mail All Orders are shipped within 24 48 hours 5 Easy Steps to Print Forms 1099 misc

1099 Misc Laser Recipients Copy B

19 Irs 1099 Miscellaneous Income Tax Stock Photo Edit Now

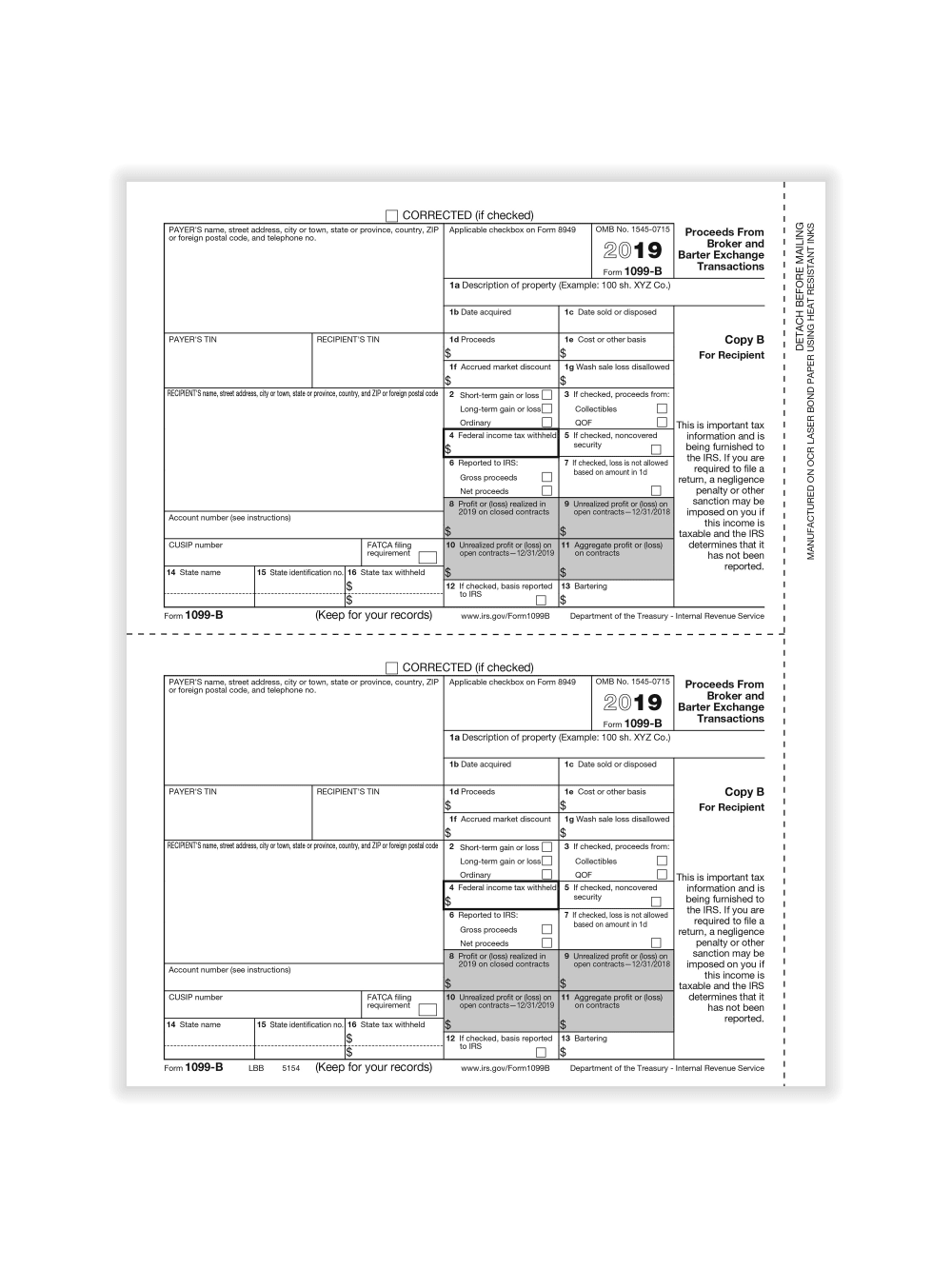

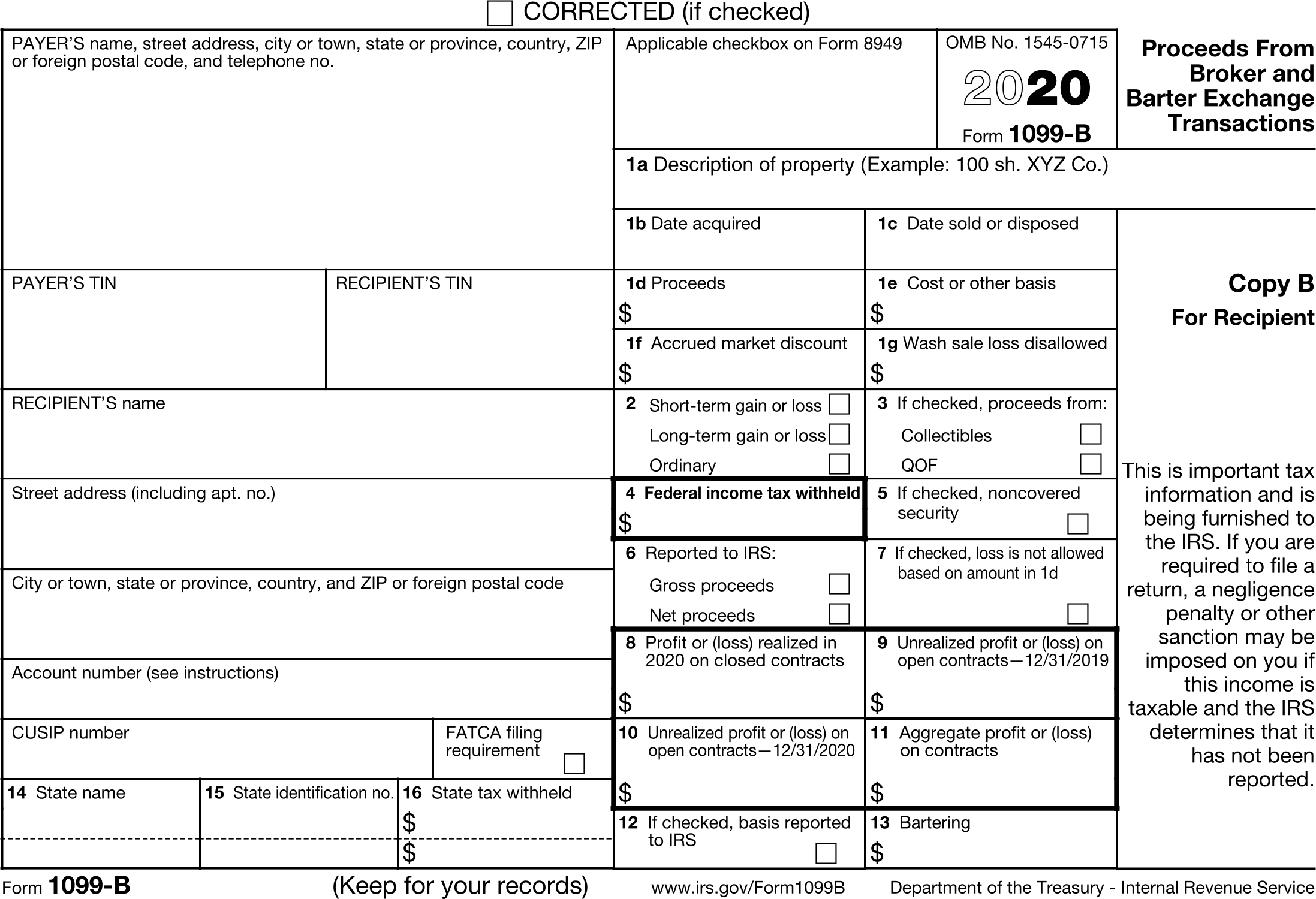

Form 1099MISC is the most common type of 1099 form Companies use it to report income earned by people who work as independent contractors rather than regular payroll employees The IRS requires businesses to file a copy of the 1099 form with them and mail another copy directly to the independent contractor so that the IRS can predict how muchVOID Form 1099B 21 Cat No V Proceeds From Broker and Barter Exchange Transactions Department of the Treasury Internal Revenue Service Copy A A 1099MISC is a form used by businesses to report miscellaneous taxable payments to many different kinds of payees Beginning with reports for the tax year, you can't use the 1099MISC form for payments you make to nonemployees ( independent contractors, attorneys, and others who provide services to your business)

Form 1099 R Wikipedia

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

1099DIV Sometimes, the individual sections of the composite forms do not include all of the information that is available on a standard 1099 form, such as the check boxes for shortterm and longterm transactions on the standard 1099B formYou may also need to send Copy 1 to your state's tax department Copy B must be sent to the recipient Copy 2 may also need to be used by the recipient for their state taxes, so make sure you give that to them Finally, there is Copy C It is for you, the payer, to retain for your records Filing due dates for 1099MISC forms have also been updated for the tax year1099DIV Copy B (1099 Dividends Copy B) For Recipient 1099DIV Copy C (1099 Dividends Copy C) For Payer All these form 1099DIV copies can be printed on blank paper with black ink Our 1099 DIV System prints ON the following official IRS laser forms Laser Copy A of form 1099 DIV (1099 Dividends Laser) For Internal Revenue Service Center

2

1099 S Transferor Copy B For 50 Recipients Forms Recordkeeping Money Handling Office Supplies Ekoios Vn

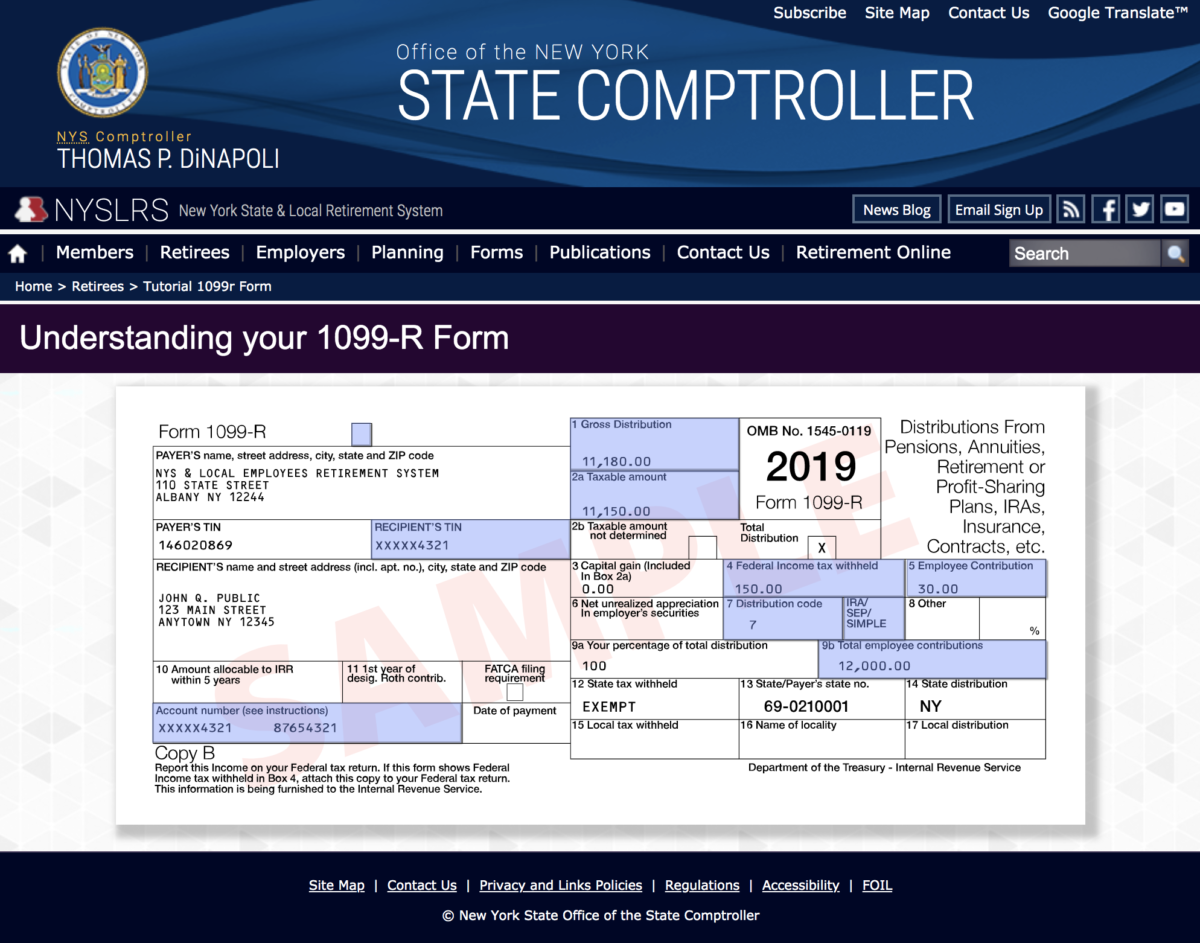

1099MISC Recipient Copy B Availability In stock Use the 1099MISC Recipient Copy B to print and mail payment information to the recipient (payee) for submission with their federal tax return Year * Choose option 19 * Required Fields Buy 50 for $018 each and save 25% Buy 100 for $011 each and save 55%The 1099 MISC form is among the most popular used by the IRS It reports the total earnings received by a person, generally an independent contractor or selfemployed individual Clients send out these forms every year in place of a W2, which is used for traditional employers and employees However, Form 1099 MISC can also be a catchall for other types of miscellaneousEach year, IRS 1099R forms are processed and mailed out by January 31st for the prior year If you are in need of a duplicate copy of your 1099R form, you can order a digital download here You will receive Copy B, Copy C, and Copy 2 for each applicable year The file(s) will be delivered via email in PDF format to the email address you provide, within three business days

1099 Misc Form Fillable Printable Download Free Instructions

I Forgot To Send My Contractors A 1099 Misc Now What

Fill Online, Printable, Fillable, Blank form 1099miscc miscellaneous income 19 Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable The form 1099miscc miscellaneous income 19 form is 7 pages long and containsThe 19 kit includes;Easy online 1099NEC form for Tax Year Form1099onlinecom is an IRS Approved form 1099NEC Efile provider Efile 1099 NEC Form with IRS by February 1 , 21 Payers must issue 1099 NEC form Copy B to recipients on or before February 1 , 21 EFile 1099 Form

Office Depot

Performing 1099 Year End Reporting

1099 FILING DEADLINES January 31 – All W2 & 1099 Recipient Postmarked; 1099MISC Reprint of Copy B from Quick Employer Forms For my 19 returns, I upgraded to TTax Home & Business specifically because I wanted the advertised ability to eFile my 1099MISC forms and know that my current 19 data would be saved online for quick & easy transfer to next year (1) It turned into a timewasting hassle toHow to fill out the Get And Sign 1099 B 1019 Form online To get started on the document, utilize the Fill & Sign Online button or tick the preview image of the blank The advanced tools of the editor will lead you through the editable PDF template Enter your official contact and

Www Lpl Com Content Dam Lpl Www Documents Disclosures 19 1099 Tax Form User Manual Pdf

1099 Misc Tax Forms 19 Tangible Values 4 Part Kit With Envelopes Software Download Included 25 Pack Buy Online In Aruba At Aruba Desertcart Com Productid

Email Or Print Copies Of The 1099 Misc 19 Form Once a client prepared an IRS 1099 tax return, the client sends Copy B to all of your recipients before or on The client can email Copy B of federal tax 1099 Misc form to the recipient, but the first client needs recipient consent to The due date to file Copy A of Form 1099NEC with the IRS is January 31 of the following year If this date does not fall on a business day, the due date will be the next business day Similarly, the deadline to provide Copy B of Form 1099NEC to contractors is January 31 of the following yearOrder laser 1099MISC income forms, Recipient Copy B from Deluxe Popular format for reporting miscellaneous payments and nonemployee compensation

Printable 1099 Forms Copy B Fill Online Printable Fillable Blank Pdffiller

Understanding 1099 Form Samples

Load the same number of 1099 Copy B forms (black preprinted forms OR blank paper if Print Friendly) in your printer, and repeat the print step above This is the state copy This is the state copy If you participated in the combined federal/state eFiling program for 1099MISC, you do not need to print Form 1099MISC Copy B1099B 19 Proceeds From Broker and Barter Exchange Transactions Copy A For Internal Revenue Service Center File with Form 1096 Department of the Treasury Internal Revenue Service OMB No For Privacy Act and Paperwork Reduction Act Notice, see the 19 General Instructions for Certain Information Returns 7979 CORRECTED Cat No V21 $2349 1099MISC Federal Copy A Income Form, 100 Laser Tax recipients Pack 49 out of 5 stars 25 $1907 (1 Pack 100 Sheets) W2 4Up Employee Tax Forms,"Instructions on Back" for , for Laser/Inkjet Printer Compatible with QuickBooks and

1099 Misc 4 Part Tax Form Kit For 25 Designed For Quickbooks And Accounting Software Walmart Com Walmart Com

What Is The 1099 Form For Small Businesses A Quick Guide

If you entered the information from the 1099R into Turbo Tax, that information will be transmitted in the efile If any forms need to be printed and mailed separately, it will prompt you and give you instructions View solution in original post 0 243 Reply1099NEC Form Copy A (2Up) For IRS 1099NEC Form Copy B (2Up) For Recipient 1099NEC Form Copy C (2Up) For Payer 1099NEC Form Copy 1 (2Up) For State Tax Department 1099NEC Form Copy 2 (2Up) To be filed with recipient's state income tax return, when required 1096 Form Annual Summary and Transmittal of US Information ReturnsForm 1099 B Form 1099B is used to report the proceeds from the Broker and Barter Exchange Transactions A Form 1099B should be filed for each person for whom the stocks, commodities where sold for cash Form 1099B is also used to report stock acquisition of control or change in the capital structure

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099MISC Miscellaneous Income (Info Copy Only) 21 Form 1099MISC Miscellaneous Income (Info Copy Only) Inst 1099MISC Instructions for Form 1099MISC, Miscellaneous Income Inst 1099MISC1099NEC and W2 Federal Copy A Postmarked or efiled with IRS February 28 – Paper Copy A filed with the IRS for all 1099s except MISC March 31 – Efiled copies to the IRS for all 1099s except MISC These are Federal filing deadlines

1099 Misc Tax Form Pressure Seal W 2taxforms Com

1099 Misc Form Fillable Printable Download Free Instructions

How To File 1099 Misc Tax For Photographers Youtube

Www Irs Gov Pub Irs Prior I1099b 19 Pdf

1099 Misc 4 Part Tax Form Kit For 25 Designed For Quickbooks And Accounting Software Walmart Com Walmart Com

Irs Form 1099 B

3

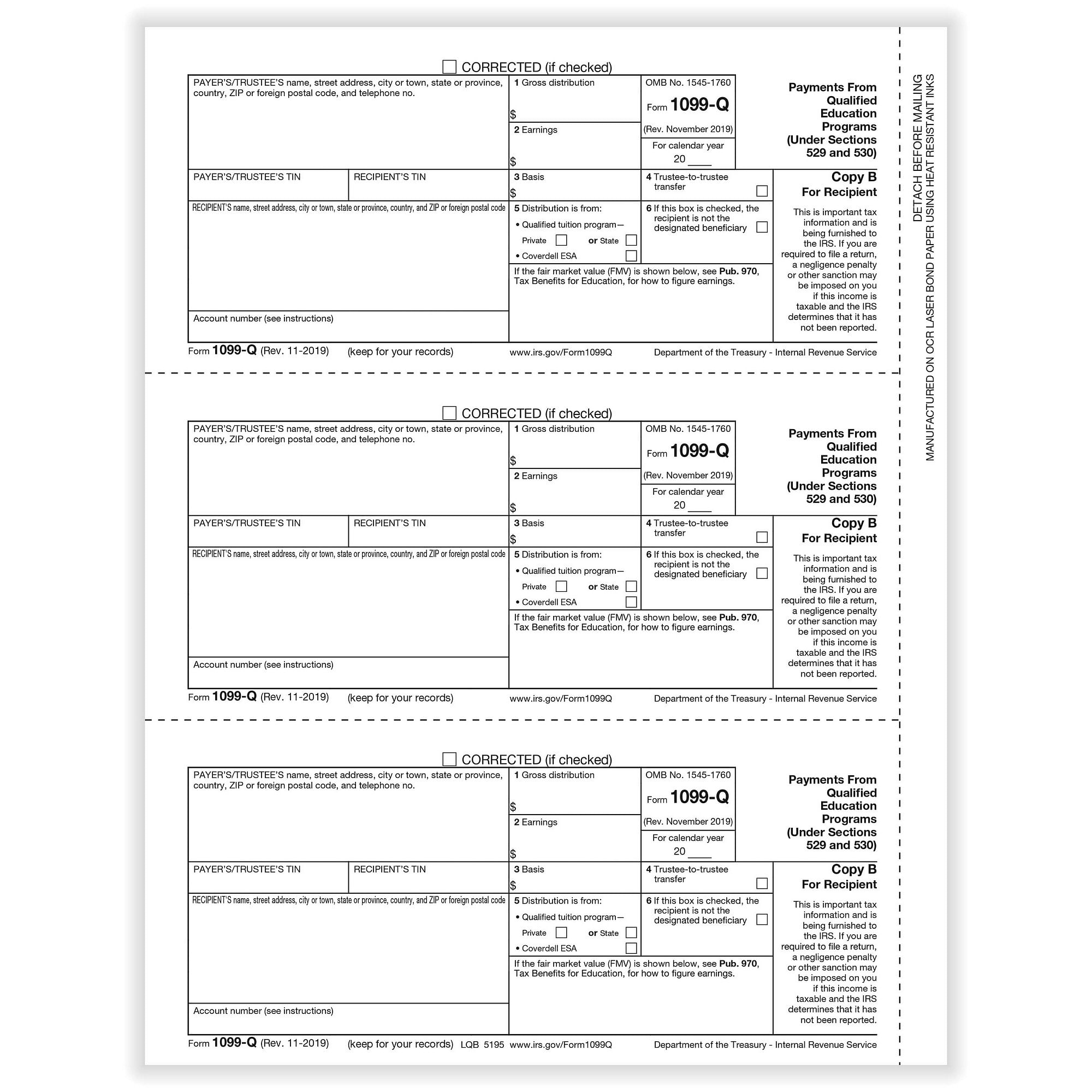

1099 Q Tax Form Copy B Laser W 2taxforms Com

Do You Need To Issue A 1099 To Your Vendors Accountingprose

What Are Information Returns Irs 1099 Tax Form Types Variants

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Index Of Forms

1099 B Copy Fill Online Printable Fillable Blank Form 1099 B Instructions Com

1096 Laser Transmittals Irs Approved 1099 Misc Tax Forms For 19 Returns 4 Part Kit 4part 100 8 5x11inches 100 Pack Office Supplies Tax Forms Malibukohsamui Com

Www Irs Gov Pub Irs Prior I1099msc 19 Pdf

How To Fill Out And Print 1099 Nec Forms

1099 Misc Bulk Tax Forms Copy B Only For 19 1 000 Filings 500 Sheets 2 Up Per Page Human Resources Forms Office Products Ohmychalk Com

3 Part Set Checksimple 19 1099 Misc Tax Forms Bundle With 1099 Envelopes 10 Pack For Laser Printers Forms Recordkeeping Money Handling Office Supplies Ekoios Vn

Www Lpl Com Content Dam Lpl Www Documents Disclosures 19 1099 Tax Form User Manual Pdf

Tax Form 1099 Div Copy B 2 Recipient 5131 Form Center

What Is Form 1099 Nec For Nonemployee Compensation

Instant Form 1099 Generator Create 1099 Easily Form Pros

1099 Misc Forms 19 4 Part Laser Tax Forms 50 Vendors Kit With Self Seal Envelopes Pack Of Federal State Copy S 1096 S Great For Quickbooks And Accounting Software 19 1099 Misc Amazon In Office Products

1099 Misc Form Copy B Recipient Discount Tax Forms

21 Laser 1099 Misc Income Recipient Copy B Deluxe Com

Www Irs Gov Pub Irs Prior F1099msc 18 Pdf

1099 Misc Form Fillable Printable Download Free Instructions

Www Raymondjames Com Media Rj Dotcom Files Wealth Management Why A Raymond James Advisor Client Resources Tax Reporting 19 Composite Form 1099 Guide Pdf

Kerr Forms

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Understanding The 1099 Misc Tax Form

W 9 Vs 1099 Understanding The Difference

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

Alere Checks Checks Tax Forms And Envelopes

Www Raymondjames Com Media Rj Dotcom Files Wealth Management Why A Raymond James Advisor Client Resources Tax Reporting 19 Composite Form 1099 Guide Pdf

:max_bytes(150000):strip_icc()/Screenshot31-f811e886d8fd4dc183e95ee360004fb3.png)

Irs Form 1099 A What Is It

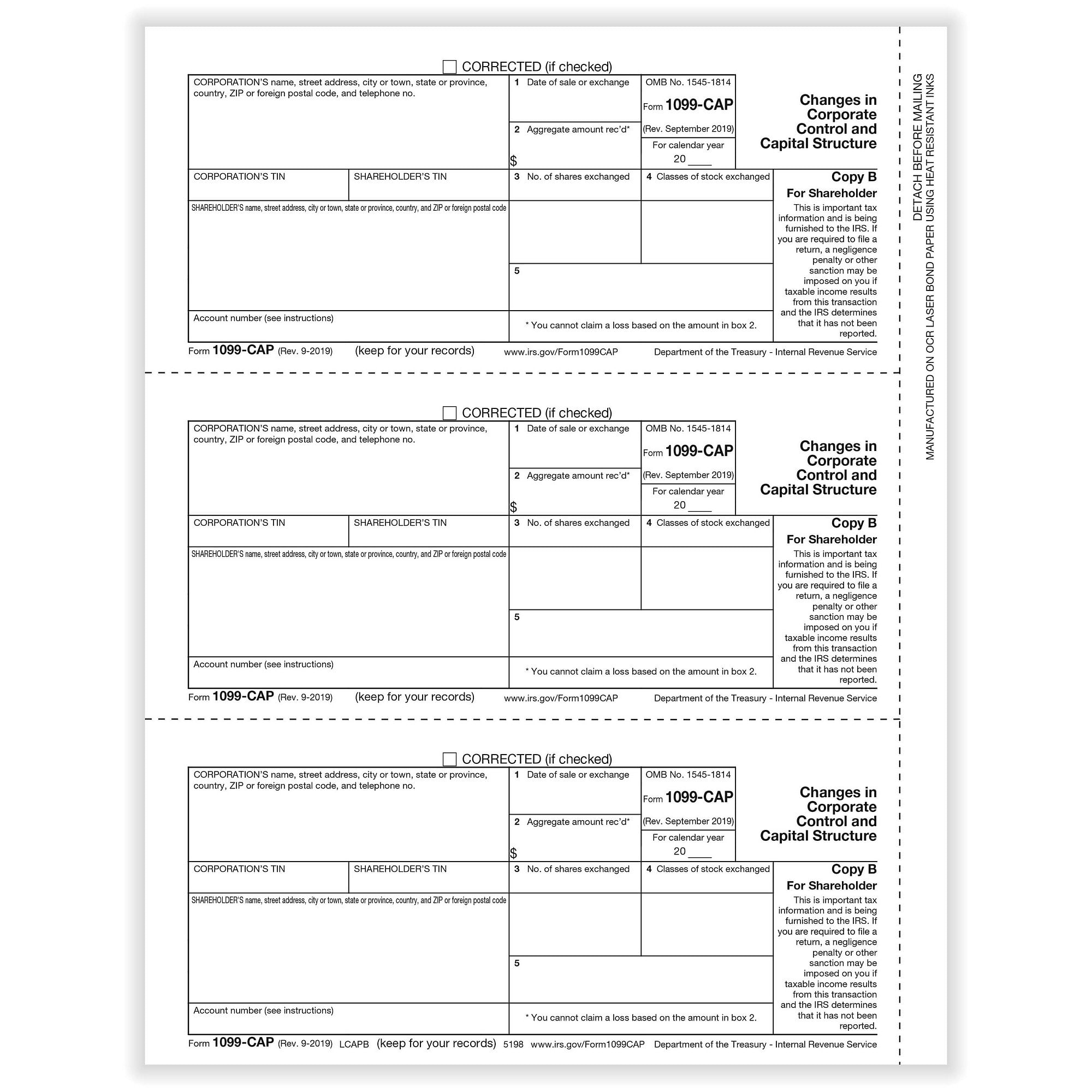

1099 Cap Changes In Corp Control Capital Structure Shareholder Copy B Cut Sheet 500 Forms Pack

F 1099 Misc

19 Office Depot 1099 Misc 4part Tax Forms 50ct For Sale Online Ebay

1099 Pressure Seal Forms

1099 Form Fillable And Printable Irs Pdf

Www Edwardjones Com Us En Media

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

Irs Form 1099 Nec Line By Line 1099 Nec Instruction Explained

Office Depot

Two 1096 2up 4 Envelopes 19 Irs Form 1099 Misc For 4 Recipients Forms Record Keeping Business Industrial

1

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Weaver Assurance Tax Advisory Firm

100 Pk Recipient Copy B 19 Laser 1099 Misc Tax Forms Human Resources Forms Forms Recordkeeping Money Handling Btsmakina Com

Forms For Rainmaker

Time To Send Out 1099s What To Know

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 18 Templateroller

Tax Form 1099 R Copy B Recipient 5141 Form Center

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

What Are The Requirements To Not Report All Stock Transactions On The Tax Return 1099 B Personal Finance Money Stack Exchange

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Hw Co Cpas Advisors

Tax Forms 100 Pk Recipient Copy B 19 Laser 1099 Misc Tax Forms Office Products

1

1099 Deadlines Penalties State Filing Requirements For 21 Checkmark Blog

1099 Forms And More At Everyday Low Prices Discounttaxforms Com

1099 R Tutorial Archives New York Retirement News

1099 Sa Tax Form Copy B Laser W 2taxforms Com

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Original Issue Discount Definition

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

How To Read A W 2 Earnings Summary Credit Karma Tax

Irs Form 1099 K Payment Reporting Under California Ab 5

What Is A 1099 Form H R Block

1099 Misc Form 19 Print 1099 Form 1099 Online Filing For 19

100 Pk Recipient Copy B 19 Laser 1099 Misc Tax Forms Human Resources Forms Forms Recordkeeping Money Handling Btsmakina Com

Amazon Com 1099 Misc Forms 21 4 Part Tax Forms Kit 25 Vendor Kit Of Laser Forms Compatible With Quickbooks And Accounting Software 25 Self Seal Envelopes Included Office Products

1099 Q Qualified Tuition Payments Rec Copy B Cut Sheet 500 Forms Pack

Irs Form 1099 Misc Miscellaneous Income Lies On Flat Lay Office Table And Ready To Fill U S Internal Revenue Services Paperwork Editorial Stock Photo Image Of 1099misc

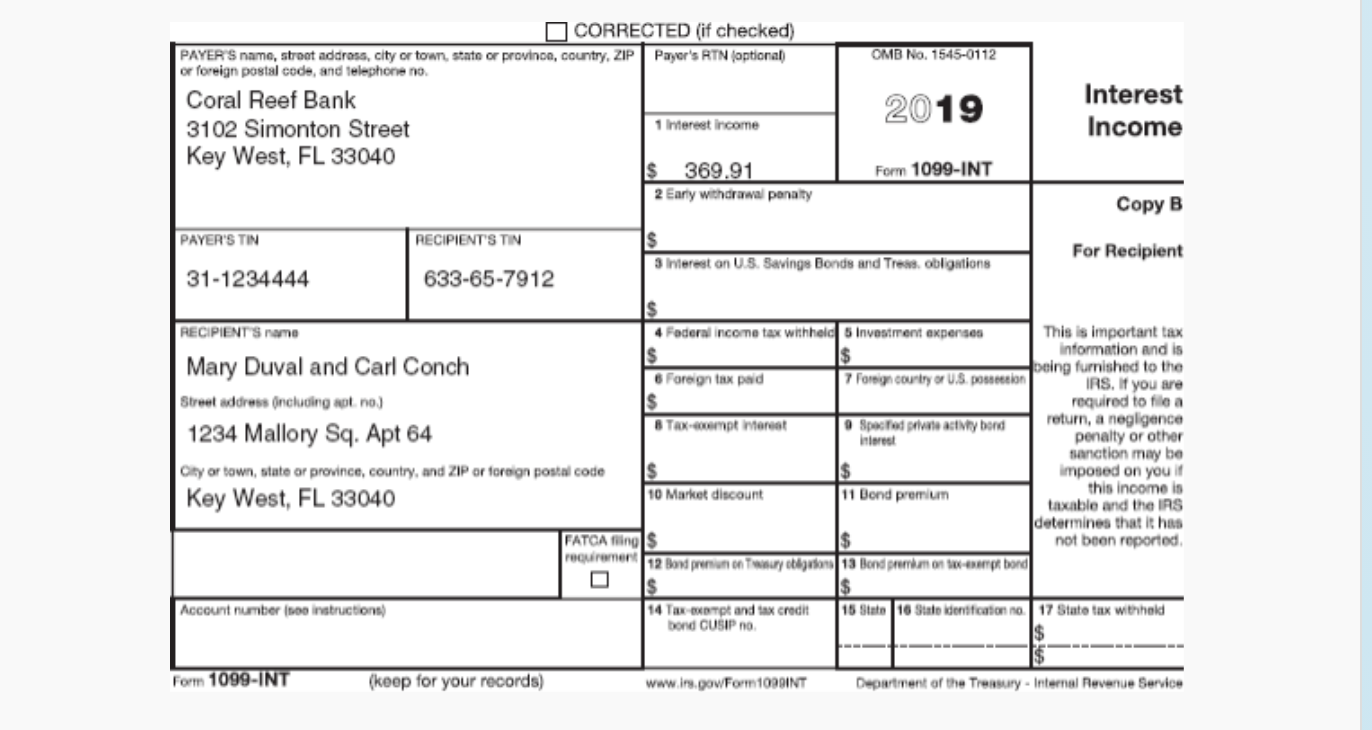

Carl Conch And Mary Duval Are Married And File A Chegg Com

Recipient Copy B Egp Irs Approved 1099 G Laser Tax Form Government Payments Quantity 100 Recipients Tax Forms

100 Pk Recipient Copy B 19 Laser 1099 Misc Tax Forms Human Resources Forms Forms Recordkeeping Money Handling Btsmakina Com

1099 Misc Form Copy A Federal Discount Tax Forms

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Form 1099 Nec Requirements Deadlines And Penalties Efile360

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

0 件のコメント:

コメントを投稿